Blogs

- Details

- Hits: 1640

🏡 UK & Isle of Wight Property Market Update – May 2025

From the team at Red Squirrel Property Shop

If you’re active in the Isle of Wight property market—or just watching closely—you’ve probably noticed: the market is shifting again. But this isn’t the chaos some headlines would have you believe.

Right now, it’s not about panic. It’s about preparation.

Here’s a no-nonsense look at what’s really happening in the UK and local property market, what it means for buyers, sellers and investors on the Island, and where we see the opportunities in 2025.

- Details

- Hits: 1253

Breaking Into the Housing Market: A Guide for First-Time Buyers

Buying your first home is one of the most exciting however scary things you will ever do In your life.

It comes with a lot of decision making and financial decisions however with the right information and mindset, you can navigate the process confidently and find a place you’ll be proud to call home.

Whether you're just starting to browse listings or seriously considering a down payment, this guide will walk you through the key steps of the home-buying journey.

- Details

- Hits: 1287

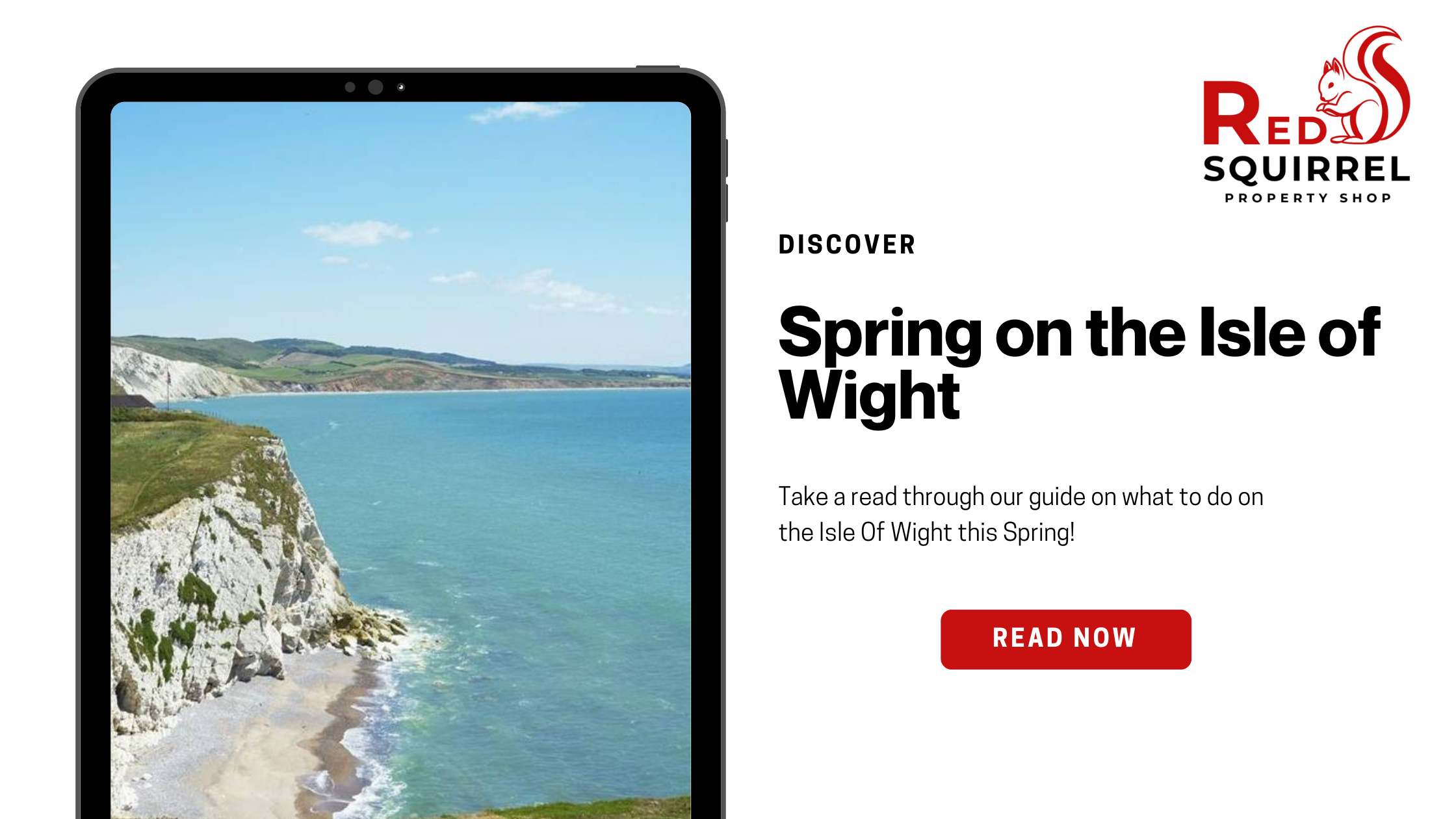

Discover Spring on the Isle of Wight

The Isle of Wight, just a short ferry ride from the mainland, is a treasure trove of natural beauty, historic landmarks, and charming villages.

While it’s an incredible place to visit year-round, there’s something truly magical about spring on the island.

As the days are getting lighter Spring is the best time to explore the islands beautiful landmarks and attractions. It is also a great time to view properties if you are on the hunt for a property on the Isle of wight.

- Details

- Hits: 2122

Finding the right letting agent is crucial for landlords and tenants alike all over the UK. A reputable letting agent can streamline the rental process, ensure legal compliance, and provide peace of mind throughout the tenancy. With numerous options available, it's essential to know what factors to consider when selecting a letting agent.

In this guide, we will help you key point factors to consider to help you make your decision.

- Details

- Hits: 2067

Summary

- UK rental inflation slows to +6.6%

- London leads the slowdown with rents up 3.7% over last 12 months

- Rental still +2x pre-pandemic

- Supply of homes for rent up 18% but still 1/3 below pre-pandemic

- Rents have fallen in some major cities over last quarter

- Rental growth in most affordable areas of the UK

- Rents continue to outperform wage increases

- Supply/demand imbalance will continue

- Will politics affect the rental market?

3 Langley Court, Pyle street, Newport, Isle Of Wight, PO30 1LA

Tel: 01983 521212 (opt 1) | Email: enquiries@redsquirrelpropertyshop.co.uk

Properties for Sale by Region | Properties to Let by Region | Cookies | Privacy Policy

©

Red Squirrel Property Shop. All rights reserved.

Powered by Expert Agent Estate Agent Software

Estate agent websites from Expert Agent