Latest News

- Details

- Hits: 230

Why People Say the UK Property Market Is “Dead” - And Why It Really Isn’t.

If you’ve chatted with anyone about property lately, you’ve probably heard someone say, “the market’s dead.”

But here’s the truth, it’s not dead at all. It’s just different.

After several years of post-pandemic, record-low interest rates, and properties selling in days for over the asking price, the market was bound to cool. What we’re seeing now in 2025 isn’t collapse, it’s correction.

- Details

- Hits: 246

Why People Say the UK Property Market Is “Dead” - And Why It Really Isn’t.

If you’ve chatted with anyone about property lately, you’ve probably heard someone say, “the market’s dead.”

But here’s the truth, it’s not dead at all. It’s just different.

After several years of post-pandemic, record-low interest rates, and properties selling in days for over the asking price, the market was bound to cool. What we’re seeing now in 2025 isn’t collapse, it’s correction.

- Details

- Hits: 324

How to Give Your Home the Best Chance of Selling at a Higher Price

Everyone’s saying the high-end property market is “struggling” right now. I don’t fully agree. Homes at the upper end of the market can and do sell, but only when they’re presented and marketed properly.

We’ve just agreed a couple sales at £1 million+, right at the top end locally, and it went because the presentation and marketing matched the price point. In my experience throughout the UK, the difference between a property that sits and one that sells often comes down to the small details.

- Details

- Hits: 774

When’s the Best Time to Sell Your Home?

On the Isle of Wight, many assume July and August are the best months to sell because the Island is busy with holidaymakers.

In reality, they’re usually the quietest. Families are away, kids are off school, and buyers are distracted. You might get viewings, but not always serious offers.

- Details

- Hits: 793

ߏ栒ed Squirrel Wins Three National Awards for Charity & Community Impact!

We are thrilled to share that Red Squirrel Property Shop has been recognised nationally at the 2025 Agents Giving Fundraising Champions of the Year Awards, winning three prestigious awards for our ongoing commitment to supporting charities and making a difference in our community.

- Details

- Hits: 353

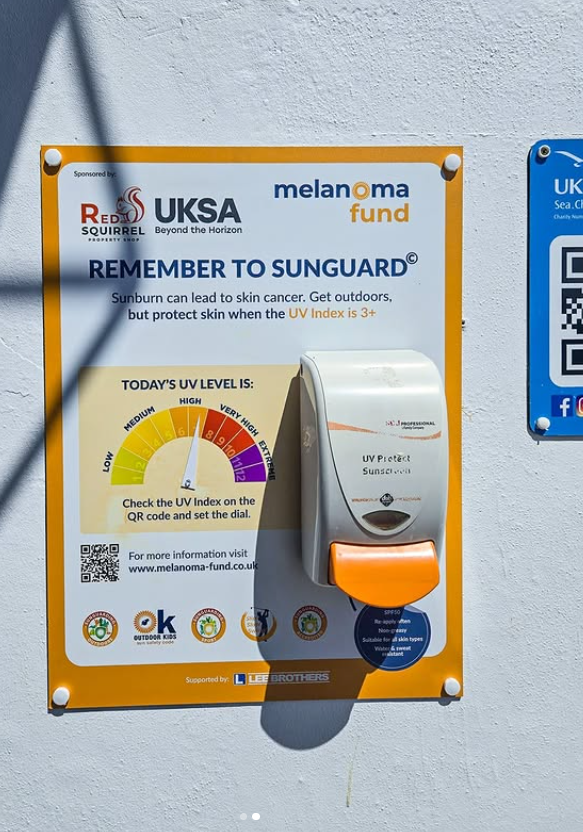

☀️ Red Squirrel Supports Sun Safety at UKSA ☀️

At Red Squirrel Property Shop, we are passionate about supporting our local community and,

we are proud to have played a part in protecting young people this summer through our sponsorship of UKSA’s Sun Safety Pledge.

- Details

- Hits: 212

The UK Rental Market: Cooling, But Still Moving

The UK rental market is active again though the heat has cooled. Rents are still on the rise, but growth has slowed to its most modest pace in years. At the same time, rental supply is starting to recover. For landlords, this signals a shift: while demand remains high, margins are tighter, tenants expect more, and the days of simply listing a property and waiting are over.

Below shows the data from previous portfolio's:

- Details

- Hits: 227

Red Squirrel Wins Social Impact Award at Chamber Business Awards

We are thrilled to share that Red Squirrel has been awarded the Social Impact Award at the Chamber Business Awards, held on Friday, 9th May at the iconic Cowes Yacht Haven.

- Details

- Hits: 440

ߏ᠕K & Isle of Wight Property Market Update – May 2025

From the team at Red Squirrel Property Shop

If you’re active in the Isle of Wight property market—or just watching closely—you’ve probably noticed: the market is shifting again. But this isn’t the chaos some headlines would have you believe.

Right now, it’s not about panic. It’s about preparation.

Here’s a no-nonsense look at what’s really happening in the UK and local property market, what it means for buyers, sellers and investors on the Island, and where we see the opportunities in 2025.

- Details

- Hits: 211

Breaking Into the Housing Market: A Guide for First-Time Buyers

Buying your first home is one of the most exciting however scary things you will ever do In your life.

It comes with a lot of decision making and financial decisions however with the right information and mindset, you can navigate the process confidently and find a place you’ll be proud to call home.

Whether you're just starting to browse listings or seriously considering a down payment, this guide will walk you through the key steps of the home-buying journey.

- Details

- Hits: 207

Discover Spring on the Isle of Wight

The Isle of Wight, just a short ferry ride from the mainland, is a treasure trove of natural beauty, historic landmarks, and charming villages.

While it’s an incredible place to visit year-round, there’s something truly magical about spring on the island.

As the days are getting lighter Spring is the best time to explore the islands beautiful landmarks and attractions. It is also a great time to view properties if you are on the hunt for a property on the Isle of wight.