Isle of wight Monthly report 2023

Overall, over the past month we have seen a very positive market on the Isle of Wight, with plenty of activity and a 1.2% increase on last month for year-on-year average price of isle of wight homes with current average at £379,765. There is no sign of buyer demand dropping as we speak, however naturally this is likely to change with the increase of mortgage rates as stated throughout the report.

Check out the average pricing for Isle of Wight Property:

Detached houses averaging at £588,420, an increase of 1.45% on last month.

Semi-detached homes have increased 1.4% last month, with an average of £338,713.

Terraced homes seeing no movement in the previous month, still averaging £274,323.

This biggest drop has been in apartments, falling by 2.1% over the last month, overall 4% down on the previous year.

Check out the UK report below!

UK Half year report 2023

Overview

- House price inflation to 1.2% increase as quarterly demand has increased

- 42% of sellers are accepting offers 5% or more under asking price

- UK house prices still on track to drop by 5% in total during 2023

- Anyone serious about selling in 2023 needs to be realistic on pricing “Falling mortgage

- 11% Hit to buying power with higher mortgage rates

- 14% Fewer buyers in the market in last 4 weeks, compared to 5-year average

Sales momentum recovered first half of 2023

Demand in sales increased through the earlier part of the year with the mortgage rates dropping towards 4%. Consumers’ confidence rebounded over the last few months also with the strong labour market, rise in earnings and a slight fall in energy prices.

Overall new sales agreed in the first 5 months of the year recovered to within 2% of the 5-year average. Leading to a small increase in house price growth, reversing the drop between October-December 2022. Other indices have shown a similar pattern recently indicating that sub 5% mortgages are consistent with +/-2% house price inflation.

Agreed sales over the last month are 8% above the average for the last 5 years. However, in the last couple weeks there are signs of demand dropping with the increase of mortgage rate.

Mortgage rates averaging between 5-6%

The first half of 2023 was better than expected, in terms of affordability for new home buyers, however with the further increase on rates, this could change. Doggedly high inflation has startled financial markets with expectations that UK interest rates peak at 6%. Mortgage rates have increased by more than 1%, now averaging between 5%-6%.

We think that if mortgage rates can stay near 5% the market will continue to perform. However, it is the tipping point, 6% will represent price falls. All data still suggests we are on track to see UK house price fall up to 5% by the end of 2023.

Buyers’ market for second half of 2023

Data suggests there are around 14% less buyers in the market since the increased mortgage rate, compared to the 5 year average. This may be the case that there could be more buyers than sellers. However, those that remain appear committed to moving home. This is evidenced by sales agreed running 8% above average, although with wide regional variations in the underlying supply/demand balance.

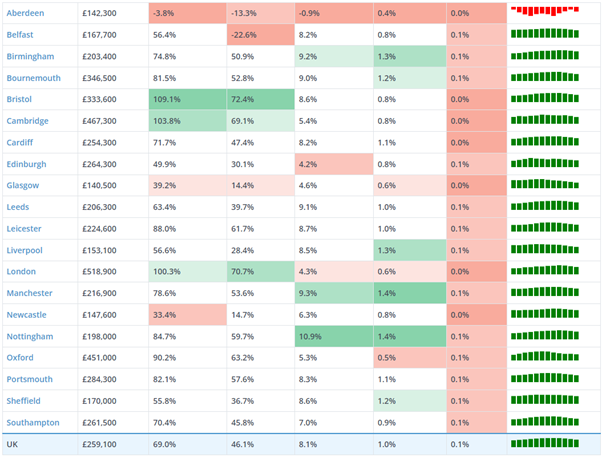

To note the areas performing above average are Scotland, North East and London.

Most English regions are performing below average, however this is natural considering the historic gains over such a short period during the pandemic years. Making homes less affordable in those areas compared to the North East.

Check out this graph to see how each area is performing:

Image from hometrack.com

Sellers having to accepted >5% of asking price

Most of this ‘below asking’ offers have come from agents over-valuing or owners being greedy when the market was booming. They should never have been on for that price in the first place, therefore the drop by 5% is only representing what they should have been on for in the first place. I am seeing that if priced correctly there is still great demand without negotiation.

However, more than two-fifths of sellers (42%) are having to accept offers that are more than 5% below the asking price, for me this is again lead by the above. Over 1 in 6 sellers are accepting discounts greater than 10% below the asking price, a level that remains more stable.

Increased supply may force price falls

Ignoring weaker economic growth, the main threat to a downturn in house prices would be the surge of supply. In the past few weeks there has been 20% higher listings than the 5 year average.

If the availability outweighs the demand, this will create a buyers’ market, leaving more room for negotiations.

The mortgage industry suggests people are choosing to pay the extra monthly costs now, rather than extend their mortgage deal. Which may push people to market their property to release the pressure on payments and potentially downsize.

Sellers must be realistic if they want to move

The desire to move home is continuing, driving by many factors, the main post-pandemic lifestyle reasoning. People now are considering why they live there, who they live with and are being more pragmatic about what they need, rather than ‘bigger the better’ attitude. With increased cost of living, along with increased mortgage costs, its likely people will continue reviewing their housing needs, with the best option being to move, whether that be out of necessity or choice.

Irrelevant of the motivations for moving, its important any sellers become realistic in their pricing, seeking views and expertise of local estate agents. Ensure any valuation you get is backed up with extensive comparable evidence, don’t just go with the highest because your bias to that view, you need evidence to justify a value.

On the Isle of wight (our local area), we are (at this moment) not seeing any difficulties in selling homes for realistically priced homes. Still achieving peak prices, however that is solely down to correct pricing, rather than sitting at an inflated price for months on end, then accepting 10% less.

Moving forward

It’s hard to say what specifically will happen over the next 6 months, however the UK housing market’s resilience will be tested, with mortgage rates increasing over the 5% region. The first half of the year will show, mortgage rates averaging up-to 5% are manageable, however if it averages above 5%, closer to 6%, it will no doubt affect the buying power substantially, in turn lowering prices.

No need to panic, as there is a huge equity buffer in UK homes to absorb the potential 5% drop, therefore risk of negative equity is unlikely, especially compared to historic downturns. The biggest challenge for homeowners is to review their affordability in detail, not just the mortgage but other living costs. Do you need Netflix, sky, paramount, amazon and apple tv? Reviewing luxuries will most definitely have to be at the top of the thought process for homeowners now. Household budgets are being squeezed and we look set for a prolonged period of low nominal house price growth which will result in a steady re-alignment of house prices and household incomes over the next 3-5 years. This still looks to perform well compared to the normal 18 year UK property cycle.